Is the 50/30/20 Budget Still Relevant? Experts Weigh In

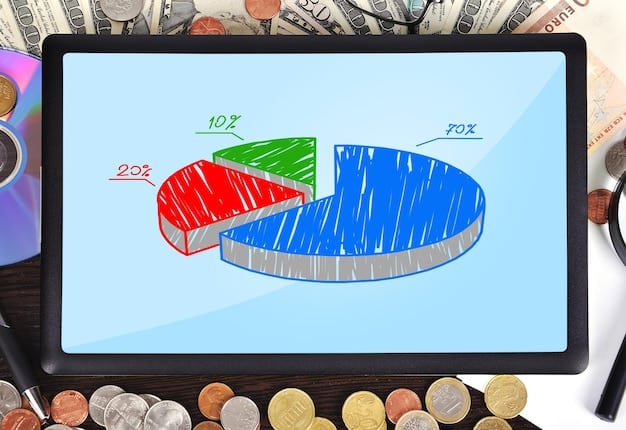

The 50/30/20 budget, allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment, remains a popular guideline, but its relevance in today’s evolving financial landscape is debated by personal finance experts due to varying economic conditions and individual circumstances.

Is the 50/30/20 budget still a practical guide in our modern financial landscape? This budgeting rule, which allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment, has been a staple in personal finance for years. But is it still relevant?

Understanding the 50/30/20 Budget Rule

The 50/30/20 budget is a simple framework designed to help individuals manage their finances effectively. It provides a clear guideline on how to allocate your after-tax income, making it easier to track spending and achieve financial goals.

Breaking Down the Categories

- 50% for Needs: This category includes essential expenses like housing, food, transportation, utilities, and healthcare. These are the costs necessary for survival and basic functioning.

- 30% for Wants: This encompasses non-essential spending, such as dining out, entertainment, hobbies, travel, and subscriptions. These are the things that enhance your lifestyle but aren’t strictly necessary.

- 20% for Savings and Debt Repayment: This portion is dedicated to building savings for emergencies, future goals (like retirement or a down payment on a house), and paying down debt (such as credit card debt, student loans, or mortgages).

The simplicity of the 50/30/20 rule is one of its most appealing features. It doesn’t require complex calculations or detailed tracking of every single expense. Instead, it provides a broad framework that can be easily adapted to individual circumstances.

The Origins and Popularity of the 50/30/20 Budget

The 50/30/20 budget gained widespread popularity thanks to Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, who introduced it in their book, “All Your Worth: The Ultimate Lifetime Money Plan.” The book offered a straightforward approach to budgeting, resonating with many who found traditional budgeting methods too restrictive or complicated.

Warren and Tyagi emphasized that the 50/30/20 rule isn’t a rigid formula but rather a flexible guideline. It’s meant to provide a starting point for individuals to assess their spending habits and make informed decisions about their finances.

The budget’s appeal lies in its balanced approach. By acknowledging both needs and wants, it avoids the feeling of deprivation that can come with more restrictive budgets. It also prioritizes savings and debt repayment, which are crucial for long-term financial security.

Why the 50/30/20 Budget Might Need Rethinking

While the 50/30/20 budget has helped many people gain control of their finances, it’s not a one-size-fits-all solution. Several factors can influence its effectiveness, including location, income level, and personal circumstances.

The Impact of Cost of Living

In high-cost-of-living areas, such as major cities, the 50% allocated for needs may not be sufficient. Housing costs, transportation, and even groceries can be significantly higher, leaving less room for wants and savings. In these cases, individuals may need to adjust the percentages to reflect their actual expenses. For example, they might need to allocate 60% or more to needs and reduce the amounts for wants and savings.

Income Level Matters

The 50/30/20 rule may also be less applicable for those with very low or very high incomes. People with low incomes may find that their needs exceed 50% of their income, leaving little room for anything else. Conversely, those with high incomes may find that they can easily cover their needs and wants while still saving more than 20%.

Ultimately, it’s important to recognize that the 50/30/20 budget is a guideline, not a strict rule. People should customize the percentages to fit their life and goals.

Personal Finance Experts Weigh In

To get a broader perspective on the relevance of the 50/30/20 budget, we consulted several personal finance experts. Here are some of their insights:

- Expert A: “The 50/30/20 budget is a great starting point for beginners, but it’s essential to adjust it based on individual circumstances. For example, someone with significant debt may need to allocate more than 20% to debt repayment.”

- Expert B: “I think the 50/30/20 framework has become outdated, especially with the rise of inflation and stagnant wages. Many people are struggling to cover their basic needs, let alone save 20% of their income.”

- Expert C: “The key is to focus on the principles behind the 50/30/20 rule, which are to prioritize needs, enjoy some wants, and save for the future. The exact percentages aren’t as important as adopting a mindful approach to spending.”

These expert opinions highlight the importance of flexibility and individualization when it comes to budgeting. The 50/30/20 rule can be a useful tool, but it shouldn’t be followed blindly without considering your unique financial situation.

Strategies for Adapting the 50/30/20 Budget

If you find that the traditional 50/30/20 budget doesn’t quite fit your needs, here are some strategies for adapting it:

Prioritize Your Needs

Start by accurately assessing your needs. Be honest about what is essential for your survival and well-being. Look for ways to reduce these costs without sacrificing quality. For example, you could consider downsizing your home, switching to a less expensive transportation option, or meal planning to reduce food waste.

Re-evaluate Your Wants

Take a close look at your wants and identify areas where you can cut back. This doesn’t mean eliminating all fun from your life but rather making conscious choices about where you spend your money. Consider alternatives like free or low-cost entertainment options, cooking at home instead of eating out, or borrowing books and movies from the library.

Increase Your Income

If you’re struggling to meet your needs and save for the future, consider ways to increase your income. This could involve taking on a side hustle, freelancing, or pursuing a promotion at work. Even a small increase in income can make a big difference in your ability to balance your budget.

Alternative Budgeting Methods to Consider

If the 50/30/20 budget simply isn’t aligning with you, it’s worth exploring some other budgeting methods that could work more favorably.

Zero-Based Budgeting

This approach requires you to allocate every dollar you earn to a specific category, ensuring that your income minus your expenses equals zero. It’s a more hands-on approach that can provide greater visibility into your spending habits. It’s also an excellent tool to ensure you’re being more purposeful with your cashflow.

Envelope Budgeting

This method involves using physical envelopes to allocate cash to different spending categories. While it may seem old-fashioned, it can be an effective way to control spending, especially for those who tend to overspend on credit cards. It also forces you to think about every purchasing decision, ensuring that you’re staying within your limits.

The Anti-Budget

For those who dislike the rigid feel of traditional budgeting, the anti-budget focuses on automating your savings and investments first, then spending the rest without guilt. It’s a more relaxed approach that can be effective for those who have a good understanding of their spending habits and are disciplined about saving.

| Key Point | Brief Description |

|---|---|

| 💰 50/30/20 Basics | Needs (50%), Wants (30%), Savings/Debt (20%) |

| 🏠 Cost of Living | Adjust percentages based on location’s expenses. |

| 💸 Income Level | May need adjustment for low or high incomes. |

| 🔄 Adaptability | Adjust spending to align with personal goals. |

Frequently Asked Questions

▼

No, the 50/30/20 budget is more of a guideline. You should adjust the percentages to fit your specific financial situation and goals.

▼

If your needs exceed 50%, try to reduce your wants and find ways to increase your income to maintain a balanced budget. Prioritize the necessities.

▼

Ideally, debt payments should be in the 20% savings/debt category. However, if they are a significant burden, include essential debt payments in your needs category.

▼

Review your budget monthly to track spending and adjust accordingly. Major life changes warrant a complete reassessment of your budgeting strategy for financial success.

▼

High-income earners may find they can comfortably save more than 20%. They can adjust the percentages to prioritize larger savings and investment goals.

Conclusion

In conclusion, while the 50/30/20 budget provides a solid foundation for financial planning, its relevance hinges on individual circumstances and economic conditions. Personal finance experts agree that flexibility and adaptability are key to creating a budget that truly works for you. So take it, tweak it, and make it your own.