Maximize Your Tax Refund in 2025: 5 Key Personal Finance Tips

To maximize your tax refund in 2025, focus on strategies like optimizing deductions, contributing to retirement accounts, utilizing tax-loss harvesting, claiming eligible tax credits, and adjusting your withholding to align with your tax liability.

Getting a tax refund can feel like a windfall, but are you really maximizing your return? Preparing in advance with the right financial strategies can significantly impact your refund amount. Let’s explore 5 personal finance tips for maximizing your tax refund in 2025, so you can make the most of your money.

Understanding Your Tax Situation

Before diving into specific tips, it’s crucial to understand your current tax situation. This involves reviewing your income, deductions, and credits from previous years to identify areas for improvement. Understanding these elements will help you make informed decisions throughout the year.

Reviewing Previous Tax Returns

Start by examining your tax returns from the past few years. Pay close attention to the deductions and credits you claimed, as well as any changes in your income. Identify any patterns or missed opportunities that could be addressed in the upcoming tax year.

Assessing Your Current Income and Expenses

Take a comprehensive look at your current income and expenses. This includes wages, investments, and any other sources of income. Track your expenses throughout the year to identify potential deductions, such as medical expenses, charitable contributions, and business-related costs.

- Compile all income statements, including W-2s, 1099s, and investment statements.

- Maintain a detailed record of all deductible expenses with receipts and documentation.

- Use budgeting tools or apps to monitor your spending and identify tax-saving opportunities.

By thoroughly understanding your tax situation, you can tailor your financial strategies to maximize your tax refund in 2025. This foundational knowledge will guide your decisions and help you take full advantage of available tax benefits.

Optimizing Deductions for Maximum Savings

Deductions are a key component of any tax strategy. Maximizing your deductions reduces your taxable income, leading to a larger refund. Below are some effective strategies for optimizing your deductions and ensuring you take full advantage of all available tax benefits.

Itemizing vs. Standard Deduction

Decide whether to itemize deductions or take the standard deduction. Itemizing allows you to deduct specific expenses, while the standard deduction is a fixed amount based on your filing status. Calculate both options to see which results in a lower tax liability.

Common Itemized Deductions to Consider

Familiarize yourself with common itemized deductions. These include medical expenses exceeding a certain percentage of your adjusted gross income (AGI), state and local taxes (SALT) up to a limit, mortgage interest, and charitable contributions.

- Keep detailed records of all medical expenses, including doctor visits, prescriptions, and insurance premiums.

- Track your state and local taxes, including property taxes and income taxes.

- Document all charitable donations with receipts and acknowledgments from the organizations.

Optimizing deductions requires careful planning and diligent record-keeping. By thoroughly understanding your options and tracking your expenses, you can significantly reduce your taxable income and increase your tax refund in 2025.

Contributing to Retirement Accounts

Contributing to retirement accounts not only secures your financial future but also provides significant tax benefits. These contributions can reduce your taxable income, leading to a larger tax refund. Let’s explore how to maximize your retirement contributions for tax savings.

Traditional IRA vs. Roth IRA

Understand the difference between traditional and Roth IRAs. Contributions to a traditional IRA may be tax-deductible, while Roth IRA contributions are made with after-tax dollars but offer tax-free withdrawals in retirement.

Maximizing 401(k) Contributions

If you have access to a 401(k) plan through your employer, consider maximizing your contributions. Many employers offer matching contributions, which is essentially free money that also grows tax-deferred.

- Determine the maximum contribution limit for your age and plan your contributions accordingly.

- Take advantage of employer matching contributions to maximize your retirement savings.

- Consider contributing to a Roth 401(k) for tax-free withdrawals in retirement, if available.

Contributing to retirement accounts is a dual-benefit strategy, offering both tax savings and long-term financial security. By maximizing your contributions and understanding the different types of accounts, you can significantly reduce your tax liability and increase your tax refund in 2025.

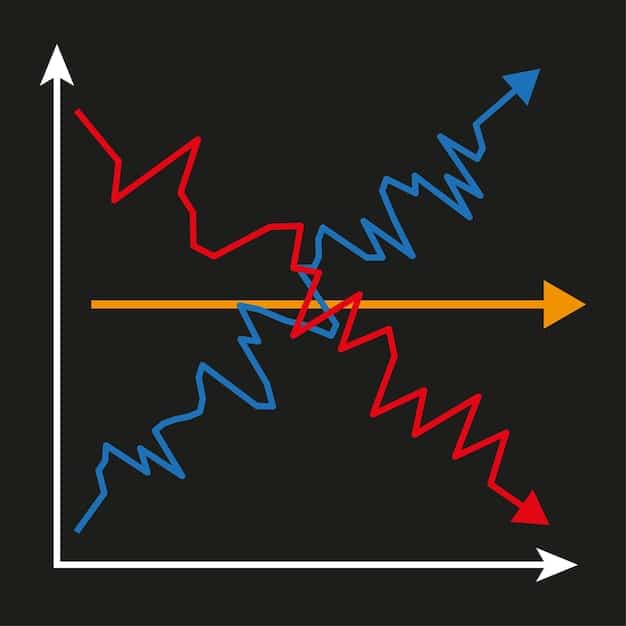

Utilizing Tax-Loss Harvesting for Investments

Tax-loss harvesting is a strategy that can help offset capital gains and reduce your taxable income. It involves selling investments at a loss to offset gains, potentially leading to a larger tax refund. Understanding how to utilize this strategy is crucial for investors.

Understanding Capital Gains and Losses

Capital gains occur when you sell an investment for more than you paid for it, while capital losses occur when you sell an investment for less than you paid for it. These gains and losses can impact your tax liability, and tax-loss harvesting can help balance them.

How Tax-Loss Harvesting Works

Tax-loss harvesting involves selling investments that have decreased in value to offset capital gains. You can use up to $3,000 of excess capital losses to offset ordinary income each year. This can significantly reduce your tax burden.

- Review your investment portfolio to identify assets that have declined in value.

- Sell those assets to realize the losses, ensuring you don’t violate the wash-sale rule (buying back the same asset within 30 days).

- Use the losses to offset capital gains and up to $3,000 of ordinary income.

Tax-loss harvesting requires careful monitoring of your investment portfolio and an understanding of tax rules. By strategically selling assets at a loss, you can reduce your taxable income and potentially increase your tax refund in 2025.

Claiming Eligible Tax Credits

Tax credits directly reduce the amount of tax you owe, making them a valuable tool for maximizing your tax refund. Understanding and claiming eligible tax credits can significantly lower your tax liability. Here are some key tax credits to consider.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is available to low-to-moderate income individuals and families. Eligibility depends on income, filing status, and the number of qualifying children. The EITC can provide a substantial tax refund.

Child Tax Credit

The Child Tax Credit is available to families with qualifying children. The credit amount can vary, and portions of it may be refundable, meaning you can receive it as a refund even if you don’t owe any taxes.

- Review the eligibility requirements for the EITC and Child Tax Credit to see if you qualify.

- Gather all necessary documentation, such as income statements and information about qualifying children.

- Use tax preparation software or consult a tax professional to ensure you claim all eligible credits.

Claiming eligible tax credits is a straightforward way to reduce your tax liability and increase your tax refund. By understanding the requirements and gathering the necessary documentation, you can take full advantage of these valuable tax benefits in 2025.

Adjusting Your Withholding to Align with Tax Liability

Adjusting your withholding throughout the year can help you avoid surprises at tax time and optimize your tax refund. Proper withholding ensures that you’re not overpaying or underpaying your taxes. Understanding how to adjust your withholding is key to financial planning.

Using Form W-4

The Form W-4 is used to tell your employer how much tax to withhold from your paycheck. You can adjust your withholding by changing the number of allowances you claim or by indicating additional amounts to withhold.

Reviewing Withholding Throughout the Year

It’s a good idea to review your withholding periodically, especially if you experience changes in your income, deductions, or credits. Use the IRS’s Tax Withholding Estimator to help you determine the appropriate amount to withhold.

- Complete the IRS’s Tax Withholding Estimator to get a personalized withholding recommendation.

- Submit a new Form W-4 to your employer to adjust your withholding.

- Revisit your withholding after major life events, such as marriage, divorce, or the birth of a child.

Adjusting your withholding is a proactive approach to managing your taxes. By using the Form W-4 and regularly reviewing your withholding, you can ensure that your tax payments align with your tax liability, potentially increasing your tax refund in 2025.

| Key Point | Brief Description |

|---|---|

| 🧾 Optimize Deductions | Maximize itemized deductions like medical expenses and charitable donations. |

| 💰 Retirement Contributions | Contribute to 401(k)s or IRAs to reduce taxable income. |

| 📉 Tax-Loss Harvesting | Offset capital gains by selling losing investments. |

| ✅ Claim Tax Credits | Utilize credits like the EITC and Child Tax Credit. |

Frequently Asked Questions (FAQ)

▼

Understanding and utilizing all available deductions and credits tailored to your financial situation is paramount for maximizing your tax refund. This includes keeping accurate records and staying informed about changing tax laws.

▼

Contributions to traditional retirement accounts like 401(k)s and IRAs can reduce your taxable income, leading to a lower tax liability and potentially a larger tax refund. It’s a win-win for long-term savings and short-term tax benefits.

▼

Tax-loss harvesting involves selling investments that have decreased in value to offset capital gains. By using these losses, you can reduce your overall taxable income and potentially increase your tax refund. Consult a financial advisor for personalized advice.

▼

Use Form W-4 to adjust your withholding. Complete the IRS’s Tax Withholding Estimator to determine the appropriate amount and submit the form to your employer. Review and update it annually or after significant life changes.

▼

Be aware of the Earned Income Tax Credit (EITC) for lower-income individuals and families, as well as the Child Tax Credit for families with qualifying children. Ensure you meet the eligibility requirements and claim all applicable credits.

Conclusion

Maximizing your tax refund in 2025 requires a proactive and informed approach to personal finance. By understanding your tax situation, optimizing deductions, contributing to retirement accounts, utilizing tax-loss harvesting, claiming eligible tax credits, and adjusting your withholding, you can significantly reduce your tax liability and make the most of your refund.