Personal Finance for Beginners: Solid Foundation in 6 Months

Personal finance for beginners involves establishing a budget, reducing debt, saving regularly, investing wisely, and protecting assets through insurance, all within six months.

Embarking on the journey of personal finance can seem daunting, especially for beginners. However, with the right strategies and a clear plan, it’s entirely possible to build a solid financial foundation in just six months. Let’s dive into the essential steps of personal finance for beginners: building a solid foundation in 6 months.

Understanding Your Current Financial Situation

Before making any changes, it’s crucial to understand where you currently stand financially. This involves taking a close look at your income, expenses, assets, and liabilities to create a clear financial picture.

Assess Your Income and Expenses

Start by creating a detailed list of all your sources of income. Then, track your expenses for a month or two to identify where your money is going. Use budgeting apps or spreadsheets to help you categorize and analyze your spending habits.

Calculate Your Net Worth

Your net worth is the difference between your assets (what you own) and your liabilities (what you owe). Calculating your net worth provides a snapshot of your financial health. Aim to increase your net worth over time by reducing debt and increasing assets.

Here are key points to consider when understanding your current financial situation:

- Identify all sources of income, including salary, investments, and side hustles.

- Categorize your expenses into fixed (e.g., rent, loan payments) and variable (e.g., groceries, entertainment).

- Use budgeting tools to automatically track and analyze your spending.

- Calculate your net worth by subtracting liabilities from assets.

Understanding your current financial situation is the foundation upon which all other financial decisions are made. It enables you to set realistic goals and track your progress effectively.

Setting Clear and Achievable Financial Goals

Having clear financial goals is essential for staying motivated and focused on your financial journey. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

Define Your Short-Term and Long-Term Goals

Short-term goals might include saving for an emergency fund or paying off a small debt. Long-term goals could be saving for retirement or purchasing a home. Prioritize your goals based on their importance and urgency.

Create a Timeline for Each Goal

Assign a specific timeframe to each financial goal. This will help you stay on track and measure your progress. Break down larger goals into smaller, more manageable steps.

To set effective financial goals, consider the following:

- Write down your goals to make them more concrete.

- Make sure your goals are specific (e.g., “save \$500 per month” instead of “save more money”).

- Regularly review and adjust your goals as needed.

- Celebrate small victories to stay motivated.

Setting clear and achievable financial goals is the compass that guides your financial decisions. It provides a sense of purpose and direction, making your journey toward financial stability more rewarding.

Creating a Budget That Works for You

A budget is a plan for how you will spend your money. It helps you control your expenses, save more, and achieve your financial goals. A well-designed budget should be realistic and tailored to your individual needs and circumstances.

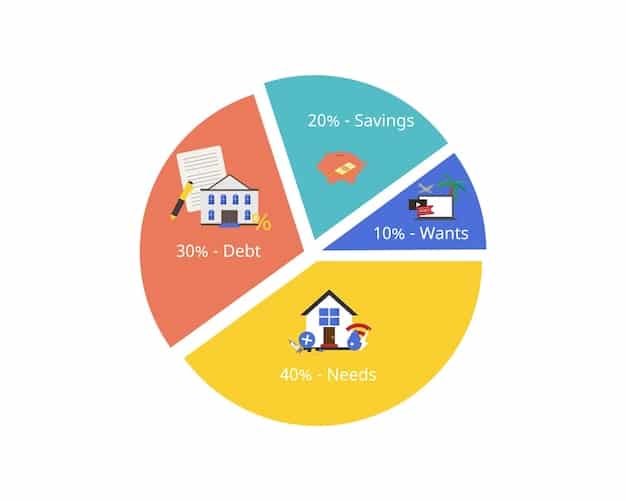

Choose a Budgeting Method

There are several budgeting methods to choose from, including the 50/30/20 rule, zero-based budgeting, and envelope budgeting. Experiment with different methods to find one that suits your preferences and lifestyle.

Track Your Spending Regularly

Tracking your spending is crucial for staying within your budget. Use budgeting apps, spreadsheets, or even a simple notebook to record your expenses. Regularly review your spending to identify areas where you can cut back.

Here are some practical tips for creating a budget that works:

- Automate your savings by setting up regular transfers to your savings account.

- Review your budget regularly and make adjustments as needed.

- Be realistic about your spending habits and avoid setting unrealistic expectations.

- Find ways to reduce your expenses, such as cooking more meals at home or canceling unused subscriptions.

Creating a budget is the roadmap to your financial success. It allows you to take control of your money, make informed decisions, and work toward your financial goals with confidence.

Paying Off High-Interest Debt

High-interest debt, such as credit card debt, can be a major obstacle to financial freedom. Paying off this debt should be a top priority. Develop a strategy for tackling your debts systematically and efficiently.

Prioritize High-Interest Debts

Focus on paying off debts with the highest interest rates first. This will save you money in the long run. Consider using the debt avalanche or debt snowball method to accelerate your debt repayment.

Explore Debt Consolidation Options

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your debt repayment and potentially save you money. However, be sure to compare different consolidation options and understand the terms and conditions.

These strategies can help you pay off high-interest debt effectively:

- Create a debt repayment plan and stick to it.

- Consider transferring balances to a lower-interest credit card.

- Negotiate with creditors to lower your interest rates.

- Increase your income through side hustles or a part-time job to accelerate debt repayment.

Paying off high-interest debt is a crucial step toward financial stability. It frees up cash flow, reduces stress, and paves the way for building wealth and achieving your financial goals.

Starting an Emergency Fund

An emergency fund is a savings account designated for unexpected expenses, such as medical bills, car repairs, or job loss. Having an emergency fund provides a financial cushion and prevents you from going into debt when faced with unexpected events. Aim to save at least 3-6 months’ worth of living expenses in your emergency fund.

Determine Your Target Savings Amount

Calculate how much money you need to cover your essential living expenses for 3-6 months. This will be your target savings amount for your emergency fund. Start small and gradually increase your savings over time.

Choose a High-Yield Savings Account

Choose a savings account that offers a competitive interest rate. This will help your savings grow faster. Look for accounts that are easily accessible but not too tempting to withdraw from.

To build and maintain your emergency fund:

- Set up automatic transfers from your checking account to your savings account.

- Treat your emergency fund as a non-negotiable expense in your budget.

- Avoid using your emergency fund for non-emergency expenses.

- Replenish your emergency fund as soon as possible after using it.

Starting an emergency fund is a cornerstone of financial security. It provides peace of mind, protects you from financial shocks, and enables you to handle unexpected expenses without derailing your financial goals.

Investing for the Future

Investing is a way to grow your money over time and achieve your long-term financial goals, such as retirement or buying a home. Start investing early and consistently, even if you can only afford to invest small amounts. Diversify your investments to reduce risk.

Open a Retirement Account

Consider opening a retirement account, such as a 401(k) or IRA. These accounts offer tax advantages and can help you save for retirement more effectively. Take advantage of employer matching contributions to maximize your retirement savings.

Diversify Your Investments

Diversification involves spreading your investments across different asset classes, such as stocks, bonds, and real estate. This helps reduce risk and increase your chances of achieving your investment goals. Consider investing in low-cost index funds or ETFs to achieve diversification.

Practical tips for investing wisely:

- Do your research and understand the risks involved before investing.

- Start with a small amount and gradually increase your investments over time.

- Consider consulting with a financial advisor to get personalized investment advice.

- Stay patient and avoid making impulsive investment decisions based on market fluctuations.

Investing for the future is an essential part of building long-term wealth. It allows you to grow your money, achieve your financial goals, and secure your financial future.

| Key Point | Brief Description |

|---|---|

| 📊 Budgeting | Track income and expenses to control spending. |

| 💸 Debt Payoff | Prioritize high-interest debts for faster repayment. |

| 🛡️ Emergency Fund | Save 3-6 months of expenses for unexpected costs. |

| 📈 Investing | Start early with diversified investments for long-term growth. |

FAQ

▼

Start by tracking your income and expenses for a month. Then, categorize your spending and identify areas where you can cut back. Use a budgeting app or spreadsheet to help you stay organized.

▼

Prioritize debts with the highest interest rates first and consider methods like the debt avalanche or snowball. Explore options like balance transfers or debt consolidation to lower interest rates.

▼

Aim to save at least 3-6 months’ worth of essential living expenses. This will provide a financial cushion for unexpected costs like medical bills or job loss.

▼

It’s always better to start investing early, even with small amounts. Start by opening a retirement account, such as a 401(k) or IRA, and diversify your investments to reduce risk.

▼

Building a solid financial foundation in six months involves understanding your finances, setting goals, budgeting, paying off debt, saving for emergencies, and investing wisely.

Conclusion

Building a solid financial foundation in six months requires commitment, discipline, and a strategic approach. By understanding your current financial situation, setting clear goals, creating a budget, addressing high-interest debt, establishing an emergency fund, and investing wisely, you can take control of your finances and pave the way for a secure financial future.