The Ultimate Guide to Emergency Funds: How Much You Need in 2025

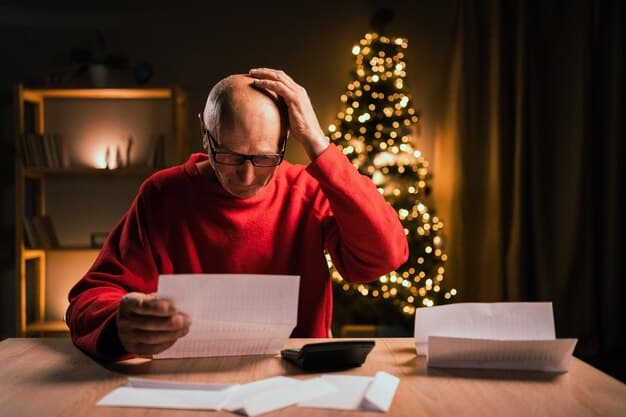

Emergency funds are crucial for financial security, and in 2025, having the right amount can protect you from unexpected expenses, job loss, or economic downturns, ensuring peace of mind and stability.

Building a financial safety net is crucial in an unpredictable world. This The Ultimate Guide to Emergency Funds: How Much You Really Need in 2025 will help you prepare for the unexpected.

Why You Need an Emergency Fund

Life is full of surprises, and not all of them are pleasant. An emergency fund provides a financial cushion to handle unexpected expenses without derailing your long-term financial goals.

Having an emergency fund can significantly reduce stress and provide peace of mind. It allows you to face unexpected challenges with confidence, knowing you have a financial buffer.

The Cost of Not Having an Emergency Fund

Without an emergency fund, you might resort to high-interest credit cards or loans to cover unexpected costs, leading to a cycle of debt.

Delaying or forgoing essential expenses, like medical care or car repairs, can have serious consequences. An emergency fund helps you avoid these tough choices.

- Avoid high-interest debt.

- Maintain your credit score.

- Prevent financial stress.

- Handle unexpected medical bills.

An emergency fund is more than just a savings account; it’s a vital tool for financial stability and resilience. It empowers you to navigate life’s uncertainties with confidence.

How Much Should You Save?

Determining the right amount for your emergency fund depends on several factors, including your monthly expenses, job security, and risk tolerance. There’s no one-size-fits-all answer, but some guidelines can help.

Most financial experts recommend saving three to six months’ worth of essential living expenses. This range provides a balance between having enough coverage and making your savings accessible.

Calculating Your Monthly Expenses

Start by listing all your essential monthly expenses, such as rent or mortgage, utilities, groceries, transportation, and insurance.

Include any recurring debt payments, like student loans or car loans. Be thorough and realistic in your calculations to get an accurate picture of your monthly needs.

- Track your spending for a month.

- Categorize your expenses.

- Determine the essential amount.

- Add a buffer for unexpected costs.

Once you have a clear understanding of your monthly expenses, you can multiply that amount by three to six to determine your target emergency fund size. Adjust the amount based on your individual circumstances and risk tolerance.

Where to Keep Your Emergency Fund

The ideal place for your emergency fund is a safe, liquid, and easily accessible account. While you want your money to be accessible, you also want it to earn some interest.

Several options offer a good balance of accessibility and interest rates. Consider high-yield savings accounts, money market accounts, or short-term certificates of deposit (CDs).

High-Yield Savings Accounts

These accounts typically offer higher interest rates than traditional savings accounts, making them a great option for growing your emergency fund.

They are FDIC-insured, providing security for your savings. Look for accounts with no monthly fees and easy online access.

- Higher interest rates.

- FDIC-insured.

- Easy online access.

- No monthly fees.

Choose an account that provides convenient access to your funds in case of an emergency. Avoid accounts with withdrawal restrictions or penalties.

How to Build Your Emergency Fund

Building an emergency fund takes time and discipline, but it’s an achievable goal with the right strategy. Start by setting a realistic savings goal and breaking it down into smaller, manageable steps.

Automate your savings to make it easier to stay on track. Set up automatic transfers from your checking account to your emergency fund each payday.

Creating a Budget

A budget helps you identify areas where you can cut back on spending and allocate more funds to your emergency savings.

Track your income and expenses to see where your money is going. Look for opportunities to reduce unnecessary spending and redirect those funds to your emergency fund.

- Track your income and expenses.

- Identify areas to cut back.

- Set realistic savings goals.

- Automate your savings.

Consider allocating a portion of any unexpected income, such as tax refunds or bonuses, directly to your emergency fund. Every little bit helps in reaching your savings goal.

Maintaining Your Emergency Fund

Once you’ve built your emergency fund, it’s essential to maintain it and replenish it as needed. Think of it as a safety net that needs regular upkeep.

Periodically review your emergency fund and ensure it still meets your needs. Adjust the amount if your expenses or financial situation changes.

When to Use Your Emergency Fund

Use your emergency fund only for true emergencies, such as unexpected medical bills, car repairs, or job loss. Avoid using it for non-essential expenses or impulse purchases.

Replenish your emergency fund as soon as possible after using it. Treat it as a revolving fund that’s always ready to handle unexpected events.

- Replenish after each use.

- Avoid for non-essential expenses.

- Review periodically.

- Adjust as needed.

Regularly check your emergency fund balance and make sure it’s earning a competitive interest rate. Consider moving your funds to a higher-yielding account if necessary.

The Role of Emergency Funds in 2025

In 2025, the importance of having an emergency fund cannot be overstated. With economic uncertainties and evolving financial landscapes, a robust safety net is more critical than ever.

Emergency funds provide a buffer against unexpected job loss, medical emergencies, or significant economic downturns. They offer a sense of security and financial resilience.

Adapting to Future Challenges

As the economy evolves, it’s essential to adapt your emergency fund to meet the changing needs. Consider factors such as inflation, healthcare costs, and job market trends.

Regularly assess your financial situation and adjust your emergency fund accordingly. Stay informed about economic trends and potential risks that could impact your financial security.

- Monitor economic trends.

- Adjust for inflation.

- Consider healthcare costs.

- Stay informed about job market trends.

An emergency fund is a dynamic tool that should evolve with your financial life. By staying proactive and informed, you can ensure it continues to provide the financial security you need.

| Key Point | Brief Description |

|---|---|

| 💰 Savings Goal | Aim for 3-6 months of essential expenses. |

| 🏦 Where to Keep | High-yield savings accounts are ideal. |

| 📈 Building the Fund | Automate savings and cut unnecessary expenses. |

| 🛡️ Maintaining | Replenish after use and review periodically. |

Frequently Asked Questions

▼

An emergency fund is a savings account specifically set aside to cover unexpected expenses such as medical bills, car repairs, or job loss. It provides a financial safety net during difficult times.

▼

Financial experts typically recommend saving three to six months’ worth of essential living expenses. This amount should cover your rent/mortgage, utilities, groceries, transportation, and other necessary costs.

▼

The best place to keep your emergency fund is in a high-yield savings account or money market account. These options provide easy access to your funds while also earning a higher interest rate.

▼

To build your emergency fund quickly, automate your savings, create a budget to cut unnecessary expenses, and allocate any unexpected income (like tax refunds) directly to your fund.

▼

Use your emergency fund only for true emergencies that threaten your financial stability. Avoid using it for non-essential purchases or impulse buys. Replenish the fund after each use.

Conclusion

In conclusion, building and maintaining an emergency fund is a critical step towards financial security. By understanding how much to save, where to keep your funds, and when to use them, you can protect yourself from life’s unexpected challenges and achieve greater peace of mind.